|

|

|

|

|

|

|

|

|

|||

|

|

|

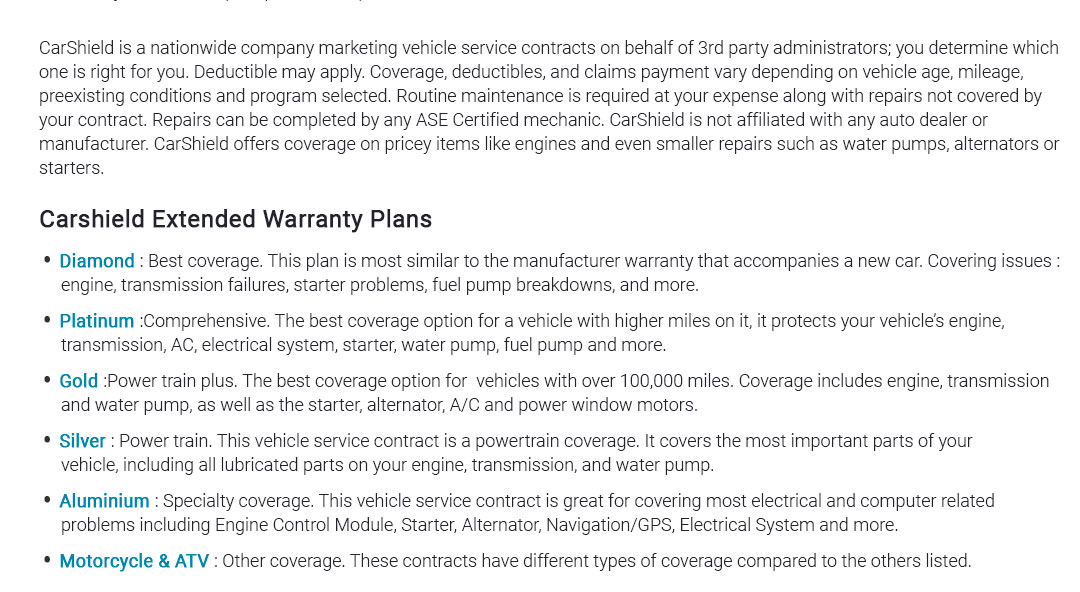

|||||||

|

|||||||

|

|||||||

|

|||||||

|

|||||||

|

|||||||

|

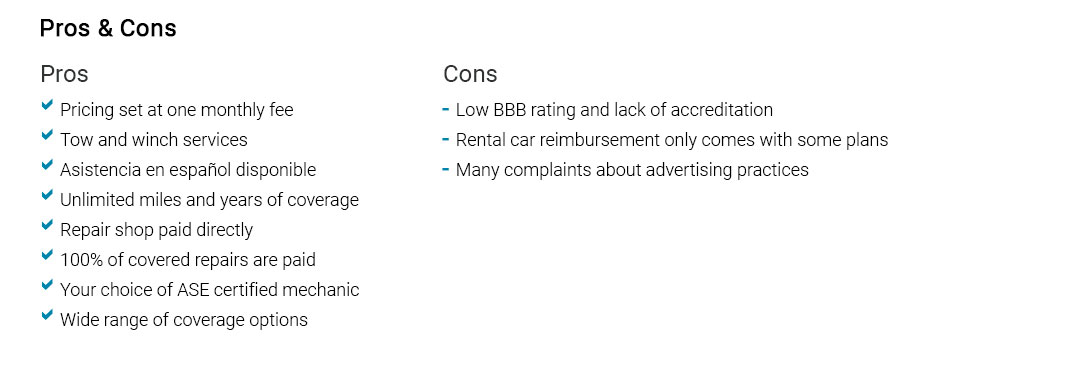

||||||

|

||||||

|

||||||

|

||||||

|

|

|

|

|

|

|

|

auto extended warranty plans explained step by stepScope, limits, and prioritiesAn auto extended warranty is a service contract that can turn surprise repair bills into predictable costs. Plans range from basic powertrain to near-bumper-to-bumper exclusionary coverage. The value case rests on two pillars: savings across your ownership window and priority handling at approved shops.

How to compare in five steps

Numbers that make it realExample: a 7-year-old crossover needs a transmission valve body ($2,100). A $1,650 plan with a $100 deductible approves next-day work; the shop moves the vehicle into a partner bay with priority authorization, and rental coverage kicks in. Net outlay $1,750 versus $2,100 - modest but tangible savings, plus less downtime during a busy week. Realistic checkDon't double-pay: if factory coverage still applies, time your start date. Maintenance lapses can void claims - keep receipts. Choose a deductible you'll actually pay under stress. If you plan to sell soon, pro-rata refunds mean gains shrink; a repair fund may beat a contract. Quick decision cues

https://www.reddit.com/r/serviceadvisors/comments/1awce60/best_and_worst_ext_warranties/

Best: US Premier Warranty, Fidelity, JMA (are they fidelity?), Silver Rock from Carvana (they're so easy to deal with), Zurich, All-State, and # ... https://fordprotect.ford.com/extended-service-plan

A Ford Protect Extended Service Plan provides peace of mind protection and offers many plan and deductible options to protect you from unexpected vehicle ... https://carshield.com/auto-warranty/

What's the difference between an extended warranty and a service contract?

|